When Gold in Nepal Loses Its Shine

Sabika Shrestha

Gold, once the safest promise in a Nepali household is now behaving like a restless gambler.

After months of relentless ascent, gold prices in Nepal have entered a phase of dramatic twists and turns, mirroring the turbulence of the international bullion market.

What was once a symbol of stability has now become a symbol of uncertainty.

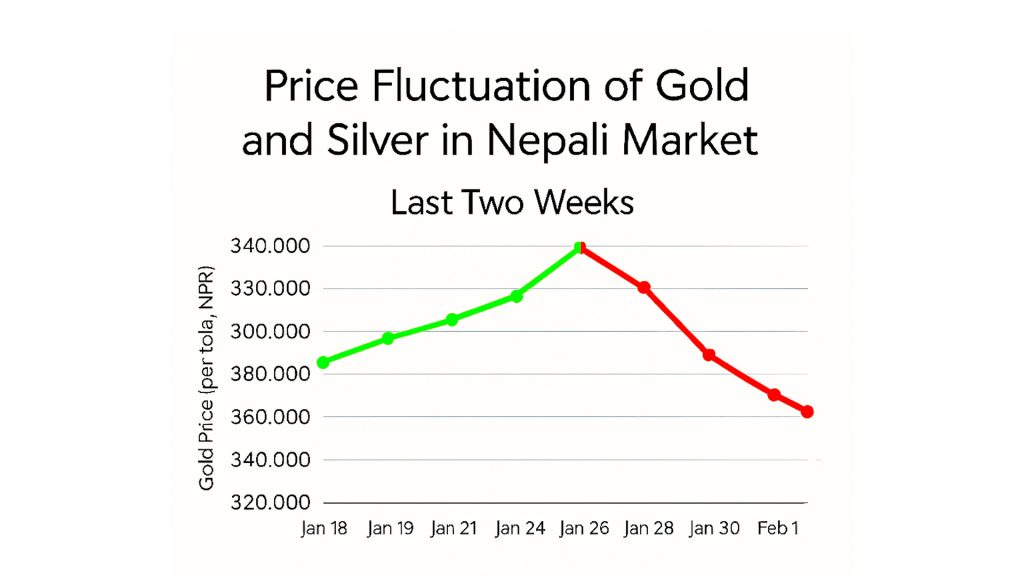

On Thursday, Nepal witnessed a historic moment in its bullion market. Gold prices surged to an all-time high of Rs 340,000 per tola, marking a staggering single-day jump of Rs 20,500, the steepest increase ever recorded in the country.

But the glitter didn’t last long.

Just a day later, prices fell sharply to Rs 318,800 per tola, sending shockwaves through traders and consumers alike, and raising a pressing question: Is this a crash or just a correction?

In just two weeks, gold prices have risen by nearly Rs 62,000 per tola. Zoom out further, and the picture becomes even more striking. Prices have climbed by almost Rs 233,000 per tola over the last three years.

For a country where gold is bought not just with money but with emotion, such volatility is deeply unsettling.

Video

Former President, Nepal Gold and Silver Dealers Federation

Former Federation President Tej Ratna Shakya cautions that the current surge appears unnatural and may invite a market correction though no one can predict when.

“The internal gold market in Nepal moves directly in line with the international market. Local traders have no room to interfere,” he says. “People are calling it a crash, but this looks more like a correction. There may be further corrections in the coming days.”

Gold’s meaning, however, is not universal.

In Nepal and across much of Asia gold is sacred. It marks weddings, births, festivals, and generational wealth. From tilhari – a traditional ornament to sikri – regular gold chains, gold is woven into identity itself. In contrast, European markets often view gold simply as a fashion accessory, an investment tool, or a hedge against inflation.

This cultural difference makes Nepal particularly vulnerable to price shocks.

As uncertainty deepens, many traders have begun pulling down their shutters, choosing caution over risk.

Video

Trader, Jai Shree Krishna Jewellers

Trader Mukesh Jodhani links the wild fluctuations to rising geopolitical tensions.

“The current market is completely unprecedented,” he says. “Prices are being driven by international issues – whether it’s the Middle East, the USA, or other global developments. As traders, we can only react, not control.”

Interestingly, this turbulence is also changing how Nepalis think.

Once bought mainly for rituals and security, gold is now increasingly seen as a risk, influenced by global trends rather than local traditions alone.

Traders believe February could be decisive, with several international developments expected to shape the direction of the bullion market.

And as fears of a global gold market crash linger, many consumers are quietly shifting their focus from gold to silver, viewing it as a safer and more affordable alternative in uncertain times.

For now, one thing is clear: In Nepal, gold may still be sacred but it is no longer stable.

Comments